By Alissa Gavrilescu on Nov 3, 2014 4:37:08 PM

Maximum Out-of-Pocket (MOOP) Limits and What They Mean to You: Important Updates Regarding the 2015 Decreases to MOOP Limits

A March 2014 final rule released by the Health and Human Services Department (HHS) outlines

revisions to the Affordable Care Act (ACA) including significantly reduced dental maximum out-ofpocket

(MOOP) cost limits for all exchange certified stand-alone pediatric dental plans sold inside and

outside the public exchanges in 2015. This revision leaves many in the dental insurance industry

pondering what the impacts will be to the industry, to consumers and to the children the pediatric

dental benefit serves. Following are key questions and answers you are sure to encounter when

presenting dental benefit options to your clients. As their trusted insurance broker, your role will be to guide your client's understanding of the 2015 ACA changes.

What will the pediatric dental MOOP look like in 2015?

The HHS Final Rule reduces the dental maximum out-of-pocket cost limit (MOOP) uniformly to $350 for

one covered child and $700 for two or more covered children in 2015. The MOOP applies in the

federally-facilitated marketplaces, state-based marketplaces as well as marketplace-certified plans

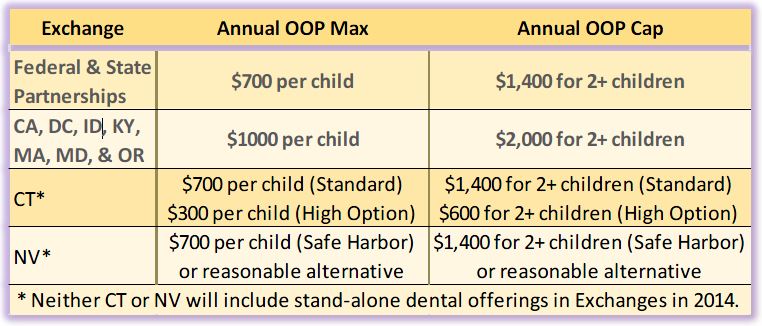

sold outside the marketplaces in the small group and individual markets. Except in Connecticut1

MOOP in 2014 was $700 or $1000 for one covered child and $1400 or $2000 for two or more covered

children.

What will this decrease in MOOP do to premiums?

Without satisfactory time or data to analyze experience under the 2014 MOOP limits, it is unclear how

the lower MOOP in 2015 and beyond will impact plan designs, premiums and the purchase of standalone

pediatric essential health benefits. To mitigate premium increases and preserve the required

levels of actuarial value, dental carriers will likely increase cost sharing from 2014 levels and /or

deductibles.

How will it affect consumer purchasing and utilization?

A key consideration when choosing any type of insurance are the out-of-pocket costs. While the MOOP

is one such consideration, consumers typically evaluate a dental plan based on premium costs. Any

increase in premiums has a direct negative impact on consumer purchasing and tends to increase plan

utilization among those who do purchase. So while a lower MOOP limit may theoretically improve the

attractiveness of a plan, it is less likely to drive consumers’ purchasing and utilization decisions2. The

most important factors remain premiums, deductibles and co-payments, which dental carriers will

need to increase in order to meet the lower MOOP in 2015.

The recent MOOP decrease will expand the estimated 3 percent of children that would benefit from

the MOOP by 2 to 3 percent; meaning 5 to 6 percent of children are estimated to reach the MOOP

limits, according to a Milliman study commissioned by the National Association of Dental Plans.

However, the families of the other 94 to 95 percent of children enrolled in a pediatric dental policy will

be faced with either higher premium or higher cost-sharing (like deductibles or copayments) without

any added value for the services they actually use.3 In summary, MOOP limits affect a small percentage

of consumers while premiums and cost-sharing affect everyone.

The ACA’s pediatric dental benefit was designed to serve uninsured children. How does the MOOP decrease benefit them?

Children in the United States miss 52 million school hours per year because of dental problems and

dental disease, leading the list as the most common childhood chronic disease4. The Affordable Care

Act included pediatric dental as an essential health benefit with the intent this would provide more

children with access to dental care. While on the surface a decrease in the pediatric dental MOOP limit

would appear to serve the goal of limiting out-of-pocket expenditures for needed pediatric services,

actual results may prove otherwise.

The new $350/$700 MOOP limit pushes the actuarial value of pediatric dental plans higher, which by

law must then be offset with increases in cost-sharing elsewhere in the plan design. One possible

candidate for this offset is in the plan deductible. Rather than covering preventive and diagnostic

services at 100 percent, dental carriers may elect to apply the deductible to these services. This shift

would be atypical of traditional dental insurance plans and would discourage utilization of needed

services, particularly preventive services, which lead to better oral health and reduce the likelihood of

major, more costly procedures in the future.

Another factor is that under the ACA, the pediatric dental MOOP applies to in-network covered

services only. With a lower MOOP pressuring premiums upward, many dental plans may turn to more

limited networks, which could reduce access to care.

What happens to the MOOP limits when dental is embedded in medical plans?

Important to note is that the maximum out-of-pocket costs for qualified medical plans in 2015 cannot

exceed $6,600 for an individual and $13,200 for a family. When the dental essential health benefit is

embedded in such a plan, dental out-of-pocket costs accrue to the higher medical plan’s MOOP. This

could lead consumers with higher anticipated levels of dental care to gravitate toward lower MOOP

standalone dental plans. This creates adverse selection and can lead to higher rates for stand-alone

pediatric dental products.

Does the MOOP affect adult only dental coverage?

No. The MOOP limits only apply to in-network services covered by stand-alone dental plans for those

under the pediatric dental coverage age limit. The limit is up to the age of 19, i.e. through age 18, in

most states. However, Centers for Medicare & Medicaid Services (CMS) granted individual states the

flexibility to extend pediatric coverage beyond the 19-year age baseline.

What is the role of brokers?

In addition to their experience and knowledge of benefit integration and service after enrollment, with

understanding of the complexities of the ACA brokers have an even greater opportunity to position

themselves as the preferred experts in the health care reform environment for groups and individuals.

Undoubtedly we will all face further challenges as revisions are made to various ACA implementation

requirements. But for us all, educating consumers on the potential effects of these revisions as they

evolve will continue to be key.

Sidebar definitions:

Maximum Out-of-pocket limit (MOOP)

The full amount a consumer would pay annually “out of their pocket for in-network benefits.” Once the

MOOP limit is met, the insurer pays all remaining dental health costs at 100%. (The MOOP excludes

premium payments.)

Cost-sharing

Any contribution consumers make towards the cost of their insurance as defined by their plan, either

up front or through their health visits. Deductibles, copayments and coinsurance are elements of costsharing.

Premiums, payments for supplies or services that are not covered or fees paid to out-ofnetwork

providers are not shared costs. Services that are covered but not considered essential health

benefits may not accrue to the MOOP.

Exchanges or Marketplaces

Online public or private marketplaces where individuals and businesses go to find out more about their

options under health care reform including insurance plans, costs and potential subsidies. This is also

where they can purchase insurance plans.

Essential Health Benefits

A set of health care service categories that must be covered by plans offered on exchanges in the small

group and individual market segments. Pediatric dental is one of the essential health benefits; adult

dental is not.

Small group

Through 2015 states have maintained the definition of small group as 50 or fewer full time employees.

In 2016, the ACA uniformly raises the size of small group to 100 or fewer full-time employees.

Actuarial Value

Health care reform establishes levels of coverage to be offered by plans on the exchanges based on

their “actuarial value” which refers to the percent of anticipated expenses the plan would cover. For

pediatric dental plans, there are two actuarial values, i.e. 70% low and 85% high. Standard dental PPO

products approximate an 85% actuarial value plan.

Article courtesy of the National Association of Dental Plans.

About the National Association of Dental Plans

The National Association of Dental Plans (NADP), a Texas nonprofit corporation with headquarters in Dallas, Texas, is the “representative and recognized resource of the dental benefits industry.” NADP is the only national trade organization that includes the full spectrum of dental benefits companies operating in the United States. NADP’s members provide Dental HMO, Dental PPO, Dental Indemnity and Discount Dental products to 160 million Americans, nearly 90% of all Americans with dental benefits. For more updates on the dental benefits industry subscribe to the weekly e-newsletter, NADP SmartBrief via www.nadp.org.

1 Connecticut had standard benefit designs which used the $700/$1400 option for standard pediatric dental plans and had a $300/$600 pediatric dental MOOP for high option pediatric dental plans.

2 Wakely Consulting Group for NORC and the Center for Consumer Information and Insurance Oversight

3 Milliman Report for the National Association of Dental Plans

4 The National Institute of Dental & Craniofacial Research

comments