By Alissa Gavrilescu on Jul 24, 2014 10:15:00 AM

Several years ago, those who worked in the insurance industry had their day-to-day routines shaken up. Health reform legislation turned broker operations on its head. Independent insurance brokers, general agents and brokerage firms were trying to find their new normal while also getting a grasp on things like MOOPS, EHBs and figuring out if their clients needed to pay or play.

Several years ago, those who worked in the insurance industry had their day-to-day routines shaken up. Health reform legislation turned broker operations on its head. Independent insurance brokers, general agents and brokerage firms were trying to find their new normal while also getting a grasp on things like MOOPS, EHBs and figuring out if their clients needed to pay or play.

Fast forward to the here and now: There are still undeniable economic changes in our industry. You can’t hide from it. From the emergence and proliferation of private exchanges, to the launch of state/federal exchanges, a new sales strategy is in order. The question now becomes: What is your value-add to your clients as a broker?

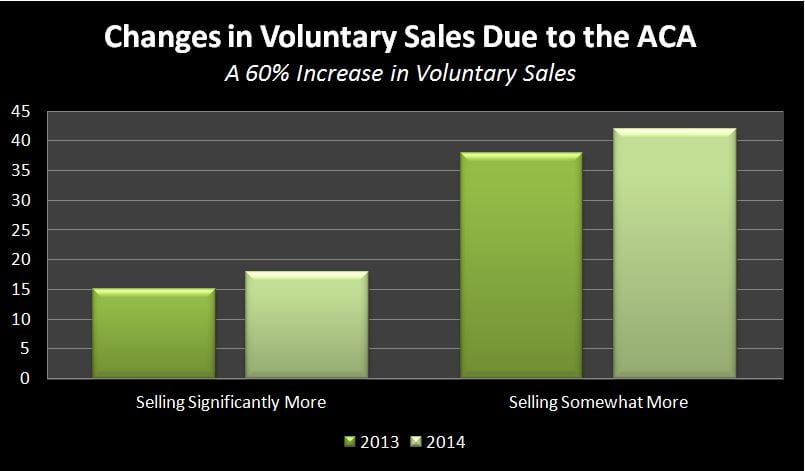

The Affordable Care Act has created a new avenue for your sales. Brokers are tapping into voluntary benefits as supplement to major medical. Even more interesting, voluntary sales have increased substantially post reform. In 2014, Voluntary sales increased by 60 percent according to the Eastbridge Marketplace Survey. The pre-ACA debate is over; reports indicate that these sales will see far more growth in the years to come compared to a broker’s non-voluntary sales.

With all this change it’s time to revisit what’s inside your sales kit.

Let’s say you wanted to refine your sales focus and allow for voluntary to take center stage…what do you need to do? First, think about partnering with a private exchange. There are many broker-friendly private exchanges that offer some pretty fancy features for both the broker and the employer group (including their employees). Privately-run exchanges offer an excellent venue for voluntary sales. You’ll find an array of products that employees have a hearty appetite for buying from traditional ancillary (dental, vision, life) to unique products like pet insurance and infertility benefits. With employer contribution models and a variety of self-service products, these exchanges provide an ideal breeding ground for voluntary commission.

Creating Customer Value

Your role as a broker is evolving into something new.

- Exchanges (both public and private) are forcing you to become more tech-savvy.

- Your clients are relying on you to navigate them through the twists, turns and changes of health reform.

- Business growth areas have shifted from medical to new sales avenues such as private exchanges, ancillary benefits and a more diverse product portfolio.

- Consumers are taking the driver’s seat. Benefits are no longer one-size-fits-all but rather what-size-fits-me.

With all these variables, what can you do to create a sustainable, profitable business?

- Embrace change. In my experience, change breeds opportunity. This is a fantastic time to position your brokerage business for success. Be open-minded to private exchanges, selling more ancillary and consider talking to your groups about the benefits of voluntary.

- Get up to speed on the latest technology tools like private marketplaces, CRM systems and even social media. (Yes, we went there.)

- Follow the news on health reform and update your clients with any impact to their organization. Don’t forward a link to an article; take the time to break it down for your clients and their employees.

- Understand the individual shopper so you can offer a product assortment that speaks to the wider needs of a defined-contribution group. Consider price, network, plan options and ease of use.

- Educate. With all this change, take the time to be consultative, caring and relevant.

It’s not business as usual anymore in the insurance world. But with the right tools in place, you can weather the changes and navigate the new landscape.

comments