By Erica Laceria on Oct 2, 2014 10:30:00 AM

Insurance brokers are being faced with a dilemma of where to invest their efforts when selling to groups and individuals. What insurance markets should I focus my efforts on? Which plans can I sell to make the most commission? Can I maximize my revenue by selling a particular insurance? If you’ve been asking yourself any of these questions, it’s time you take a closer look at dental benefits. Unlike life, medical and various other insurances, dental is an added value benefit that has been on the rise, especially in highly populated areas such as Florida. We’ve analyzed the market for information that will be of interest to you. We’ve done all the heavy lifting to help you consider shifting your efforts to dental. Here’s what we found:

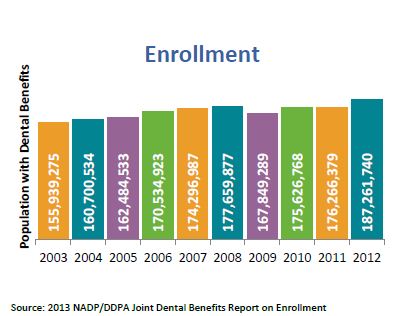

- Enrollment numbers have increased throughout the last decade

According to the National Association of Dental Plans (NADP), from 2003 to 2012 the population of people with dental benefits in Florida has increased more than 16, percent, and has continued to grow in the last two years. With the increasing requirements under health care reform for US citizens to have coverage, there’s no sign of enrollment slowing down any time soon.

- Pediatric dental is now an Essential Health Benefit under the Affordable Care Act

You may be aware that the ACA mandated that every child under the age of 16 is required to have dental coverage as an Essential Health Benefit. Florida being one of the top five most populated states in the United States (total of more than 4.2 million families according to the U.S. Bureau of Census), you can expect pediatric dental plans to skyrocket during the next year. The time to take advantage of this huge market is now!

- Premiums per member are low

Members are looking for cost effective plans with the best coverage – plain and simple. Fortunately, Florida’s dental plan premiums are averaging out to be slightly more than $30 per month, per member. Nationally, there have been premium increases anywhere from 0.2 percent for DHMO products to 1.5 percent for DPPO products. Florida is proud to be on the lower side of that scale, as should you. Low cost benefits for your clients is just another reason why selling in Florida will help your business.

- Dental benefits are now part of wellness packages

Wellness: it’s the new trend in employer benefits. Companies all over the nation are offering them as incentives for their employees, and many of them are including in dental insurance as a key component. If you work with groups – both large and small – it’s in your best interest to jump on the bandwagon. This is where you can toss in you dental plans and really help HR create a package workers will be excited to have. And, because oral health impacts overall health – from heart disease to diabetes – dental insurance is key to wellness.

- Awareness is up! Everyone needs dental benefits

We’ve mentioned before the direct correlation of dental hygiene and heart health, diabetes and various diseases – well we weren’t kidding! Now more than ever, people are looking to take care of their health and maintaining a healthy mouth is an ideal place to start. Factor health with the high demand for the perfect Hollywood smile and you have a win-win recipe for dental demand. Consider that next time you think that dental benefits won’t be of interest to your clients.

If you haven’t already, start your research and begin investing your time into the growing Florida business and markets – there’s plenty of them up for grabs. You’ll be reaping the benefits of selling dental in a short time span. If you’re not already partnered with a dental carrier, be sure to consider network types, especially open access models. Happy selling!

Resources:

NADP 2013 Dental Benefits Report: Premium and Benefit Utilization Trends, Dec 2013

http://www.census.gov/population/socdemo/hh-fam/tabST-F1-2000.pdf

comments