By Natalia Courtois on Sep 15, 2020 3:00:00 PM

Open enrollment is right around the corner and based on SourceMedia Research’s open enrollment readiness benchmark survey, most employers are not prepared for the actual process of getting employees to enroll in their plans. Preparing for open enrollment can take weeks, if not months, for some businesses. As a broker, it’s necessary to set up a meeting and go over a timeline and necessary goals to ensure a smooth enrollment process with your group. Let’s take a closer look at what groups are generally struggling with based on the readiness scores from the survey, then evaluate how you can set goals to overcome their difficulties.

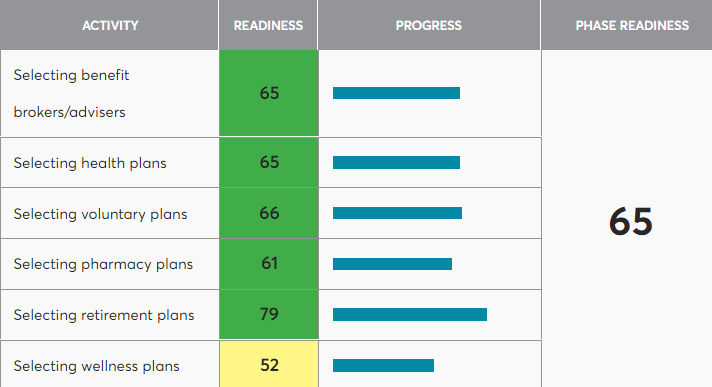

Phase One: Benefit Plan Design

This phase has the highest readiness score of 65 points. Selecting the voluntary and retirement plan options seems to be the easiest part for groups overall. However, there seems to be a general lack of preparation when it comes to wellness plans. Research the possible wellness plans your groups may be interested in and provide detailed flyers about plans such as prenatal care programs and oral cancer screenings.

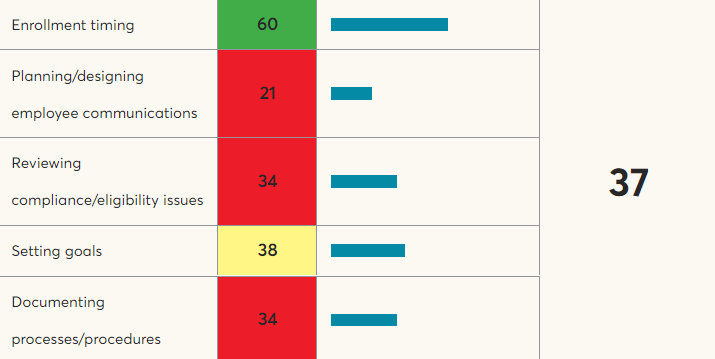

Phase Two: Open Enrollment Preparation

Around this time, the readiness score had already been reduced to 37 points. Groups seem to be the most unprepared for planning and designing employee communications. It’s also evident that setting goals, documenting processes, and reviewing eligibility issues are all things that groups are not prepared for. Set up a timeline of when communications need to go out to employees; for example, reminders could be sent out 90 days, 60 days, 45 days, and 10 days before the open enrollment deadline. For example:

- At the 90-day mark, you could send out flyers that educate the employees on their options and who to speak to for additional information.

- At the 60-day mark, you could send out a post mail, so the entire household has a chance to discuss which plan would be the best choice for the family (if applicable).

- At the 45-day mark, you could send out an email to further educate the employees on their benefits and to inform them of the upcoming open enrollment meeting.

- At the 10-day mark, you could coordinate with the HR department to send out additional reminders of the final date of open enrollment through internal communications.

Be sure to use multiple methods of communication to send out to the employees, such as email blasts and newsletters. These emails can contain general plan information, open enrollment meeting invites, and reminders. Don't forget about word-of-mouth communication either!

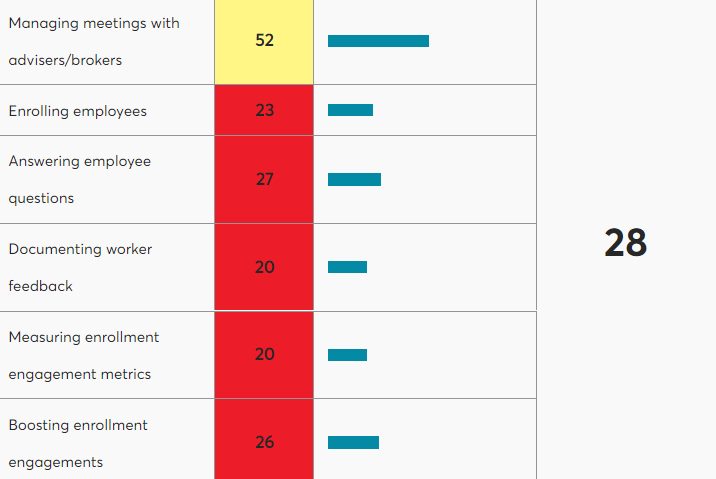

Phase Three: Open Enrollment Management

Based on the survey results, groups seem to struggle the most with documenting worker feedback and measuring enrollment engagement metrics. What were the five most frequently asked questions from last year’s open enrollment? Once you get those answers, be sure to email the document and also add a method for the employee to submit feedback or to ask additional questions. This will simultaneously boost enrollment engagements and answer employee questions.

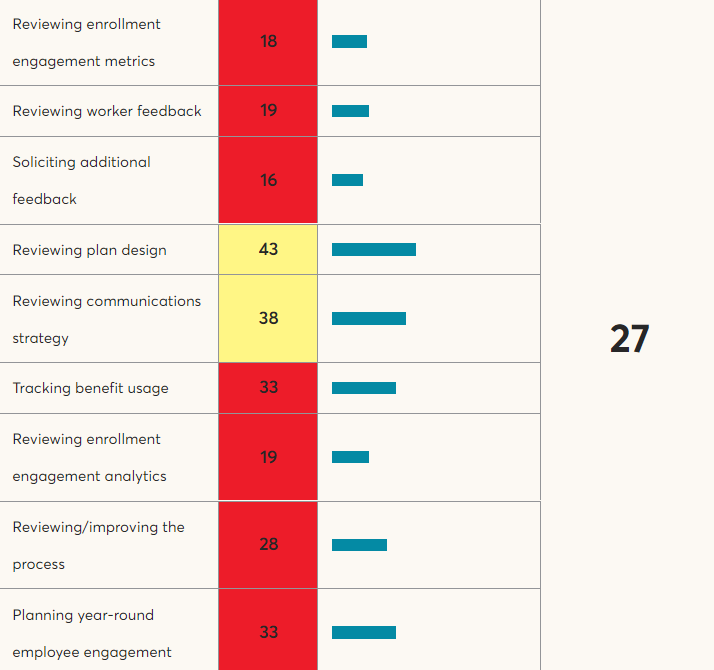

Phase Four: Open Enrollment Design Analysis and Follow-up

The last phase of open enrollment is the lowest score. Why is that? After weeks of choosing plans, setting up documents, making sure communication with employees is prioritized, and setting up multiple meetings, it’s easy to understand why reviewing employee engagement and feedback can end up being a low priority to groups. Open enrollment is a stressful period for everyone involved from beginning to end. However, this cannot be an ignored phase of open enrollment. Reviewing feedback, enrollment engagement metrics, and the general process are all very important to ensure that next year’s open enrollment is an even smoother process.

Though we observed results from SourceMedia Research’s Open Enrollment Readiness Benchmark Survey, it’s important to be mindful of your client’s specific challenges. Every group will experience different circumstances that you will need to assist them in overcoming. According to the Society for Human Resource Management, 20 percent of employees often regret the benefits choices they make. So, what can you provide to make open enrollment easier for them? Employers don’t have much time before open enrollment officially begins, so you will need to go over mutual goals and timelines with employers as soon as possible to ensure a smooth process. Click here for additional tips on making your open enrollment effective.

And if you're looking for new tools that will help you go above and beyond for your clients, check out our FREE list of the top tech tools for brokers now!

comments