By Kate Ranta on Dec 23, 2014 3:21:05 PM

Let’s face it: too many people still do not have a dental insurance plan. Yet we know that regular dental hygiene and checkups not only prevent cavities and help us keep our great smiles, they also play vital roles in helping us maintain our overall physical health.

That makes helping clients understand all the benefits of dental health insurance a top priority. Following closely in second place is helping clients understand the basic differences between a standard dental plan and a custom dental plan. Why? Because clients—and their employees—who are comfortable with their plans are more likely to go to dentists.

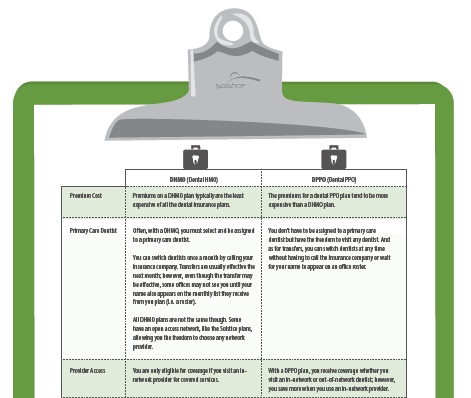

Let’s take a look at the key differences between standard and custom dental plans.

How a Standard, or DHMO, Dental Plan Works

In terms of health insurance, many people today understand what an HMO plan is and how it works. A DHMO—Dental Health Maintenance Organization—plan works in a similar way.

DHMO dentists: Like HMO plans, patients with a DHMO can choose any in-network dentist for their dentistry needs.

DHMO specialists: When the patient needs specialized dental treatments, the general dentist makes a referral to a network specialist.

Cautions: Choosing dentists outside the insurance provider’s network is not an option if patients want to benefit from their dental plan. Neither is seeing dental specialists without a referral from the general dentist.

DHMO financials: The good news is that typically there is no cap on annual dental benefits, nor any up front deductible payments in a DHMO plan. There may be a small, flat co-payment for each visit, but that is a significantly lower cost to patients than a deductible. DHMO dentists will submit insurance claims for patients, which is not always the case with custom dental plans.

DHMO benefits: DHMO dental plans save patients money. The referral system keeps costs down by ensuring that patients see specialists only when necessary as determined by a dental checkup, and by reducing the need for expensive emergency treatments since patients can afford regular checkups and dental hygiene visits. Insurers pass along savings to employers and patients in the form of lower premiums with no deductibles.

Knowing which of your clients considers costs to be their highest priority is the key to successfully brokering DHMO plans.

How a Custom, or DPPO, Dental Plan Works

DPPO dental plans also offer reduced payments for dental hygiene and treatment visits. But there are important choice/cost trade-offs with DPPO dental plans.

DPPO dentists: If the patient wants the maximum benefit from his or her DPPO plan, the patient must still choose a dentist from within the insurance provider’s network. The good news is that (1) DPPO dental plans have a wide choice of dentists from which to choose, and (2) the patient can still choose a dentist outside the provider’s network, as long as he or she is willing to pay a larger share of the cost of the dental treatments.

DPPO specialists: Patients do not need to get a referral to see a dental specialist under DPPO dental plans.

Caution: DPPOs typically include annual caps on dental plan benefits.

DPPO financials: Some deductibles can run high. Also, patients who choose dentists outside the provider’s network, wide as it is, will pay more of the treatment cost.

DPPO benefits: Choices, choices. Patients control their dental treatments by choosing their dentists and specialists without the barrier of a primary care dentist. If the patient is happy with the trade-off of cost and prefers to make choices, then DPPOs are the way to go.

As a broker, urge your employers to think about the choice vs. cost question when considering a plan for their employees. The goal is for employers to offer plans that employees will use. If employers believe that most of their workforce are extremely price sensitive, urge them to consider a DHMO plan. If your employers believe that choice trumps costs among their workforce, then urge them to go with a DPPO plan.

The key is to go with the plan that will be most likely to help employees seek out dental prevention and treatment on a regular basis.

comments