By Deborah Pinnock on Apr 11, 2017 1:59:21 PM

According to the Colonial Life/Unum U.S. Worker Benefits Survey, 76 percent of workers who believe their benefits education is strong rate their workplaces as good or excellent. And when employees feel knowledgeable, they tend to utilize their benefits more frequently. This could mean fewer absences from work due to medical or dental issues. Moreover, it helps retain and attract top talent…all the things that are important to your clients as a dental insurance broker.

Here’s the problem. Only a third of the workers in the survey say they understand their benefits. What that means is, in the months following open enrollment, employees forget the great information you and their HR administrator communicated to them. And it’s not surprising. Employees have a lot going on, so it’s tough for them to remember the ins and outs of their benefits plans from open enrollment meetings a month, or even a year ago.

Here’s your opportunity to help your clients, their employees and your business. Encourage your groups to educate employees about their benefits year-round, via an employee benefits communication plan. Then, take it a step further and in your next conversation or on-site visit, offer your clients these seven tips that will help keep employees educated and engaged post open enrollment. Talk about delivering value to your clients!

7 Tips for Communicating Dental Benefits Year Round

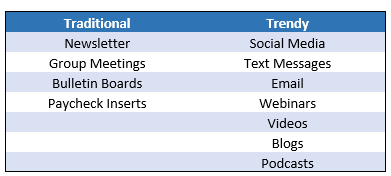

- Diversify the message: Workplaces today are diverse. Each employee benefits department varies in the resources (e.g. time and money) they have available for activities outside their core business. One employer may staff mostly millennials, while another has a convergence of the generations. So, it’s important to diversify benefits communications because no single method will work for every group. Here are a few traditional and trendy ideas your benefits administrators can use.

- Make it engaging and attractive. Let’s face it: dental insurance is not the most engaging topic on the planet. So, groups should make their communications memorable and interesting, whether they use print or digital media. It’s important to include colorful graphics, videos and storytelling. These tweaks increase the chances that busy employees will take note of benefits messages, instead of ignoring them.

- K.I.S.S. (Keep It Short and Sweet). Communicating comprehensive benefits information is fine during open enrollment. After that, to use a phrase from a popular video that went viral, “Ain’t nobody got time for that.” So, keep messages throughout the year short and strategic. They should target a behavior or focus on educating employees on a specific topic. Messages should also be easy for employees to understand and not full of jargon.

- Repeat, recycle and repackage. Your group benefits administrators are busy. Therefore, they can make life easy for themselves by re-using message content but putting them into different formats. For instance, a single message about the advantages of using in-network providers can be presented in a newsletter, an email and a short video.

- Include employee health in company strategy. Benefits administrators should advocate for employee health to become a part of their company’s overall business strategy and mission. After all, providing medical and dental insurance is a big investment. So, it makes sense for companies to ensure that employees and their families get the most value from those benefits. Providing wellness programs or benefits to employees is another way employers can send a clear message to employees about its commitment to their health.

- Request employee feedback. HR should get feedback from employees to determine their knowledge of their coverage and gauge their satisfaction with current benefits. Moreover, surveys can also help HR understand employee benefit preferences and get ideas for the future. And while they are collecting information, they might as well find out how their employees prefer to get news and info about their coverage.

- Make it fun. HR can make learning about benefits fun. For example, they could send out a quiz about benefits communications from each quarter. The first employee with the correct answers wins a gift card or movie tickets. As a way of illustrating your commitment to helping your client achieve their goals, you could also offer to sponsor the gift for one of the quizzes.

As a dental benefits broker, you want to constantly add value to your clients. Helping your clients, to help their employees, by encouraging them to communicate benefits year-round is a great way to do that. And the great news is that there are many tools and methods available to educate and excite employees about their benefits. So, make it your business to be knowledgeable about these methods and share that information with your groups. This way, you improve insurance clients focus after open enrollment, by helping them to keep their employees engaged and educated until next open enrollment.

Related Topics:

Broker Tips: How to Make Insurance Simple for Your Groups

Brokers: Talk to Your Groups About Offering Dental Insurance

7 Open Enrollment Success Tips for Brokers

comments