By Emma Becker on Sep 22, 2025 2:57:19 PM

Gen Z is poised to take over the modern workplace. This is the generation of people born between 1995 and 2012. In the United States, they (nearly 70 million people) already make up more than 20% of the total population.

Soon, Millennials will be outpaced as the largest generation represented. Gen Z is expected to make up 27% of the worldwide workforce in countries who are members of the Organization for Economic Cooperation and Development (OECD). This includes the US, Canada, the UK, Australia, France, Germany, Ireland, Japan, and Greece.

Now, what does Gen Z bring to the table, and what do they expect in return?

While offering something valuable to your business or organization, Gen Z workers know exactly what they want. They are upfront about asking for conditions they think are deserved as an employee. In the next few years, there is an expected shift in preferences where company benefits are offered on a subscription basis.

Want to make sure your business keeps up with these changes? Don't worry. Here we are to share what subscription-style benefits will look like. As an employer, you will learn about the Gen Z demand for customized benefits and how you can prepare your business.

What Are Subscription-style Benefits?

What Are Subscription-style Benefits?

Subscription-style benefits are precisely what they sound like. Whereas a traditional benefits plan is like an old cable TV bundle, a subscription model is akin to a streaming service. The subscription economy is built on unbundling: Breaking down large, rigid packages into smaller, à la carte choices. Gen Z has grown up with this model, and they expect it everywhere, including at work.

Like any subscription there will be options to choose packages and customize benefits. This contrasts with traditional benefits where employees are locked into fixed offers, such as health insurance and workers' compensation.

For example: instead of making all employees wear the same pre-printed corporate shirt, you give them high-quality blank apparel and let them choose the design. The unbundling of benefits can help you meet your modern team where they're at. It will show that you trust your people to make the best choices for themselves.

How Will Subscription-style Benefits Work?

Employees will receive a stipend or credit from the human resources (HR) department. This will be used to subscribe to the benefits options that are relevant to them.

Here are examples of subscription-style benefits in action:

- Wellness apps: Your employees can use their credits to subscribe to mental health and meditation apps, such as Headspace and Calm. This provides on-demand support for stress and well-being, an increasingly key concern in the workforce. More than 9 in 10 workers in the US have chronic stress.

- Fitness memberships: Workers can opt for flexible options, such as Gympass and Yoga classes. The goal is to allow them to tailor their fitness routines instead of adhering to a single standard fitness reimbursement program.

- Online learning platforms: Your employees can subscribe to platforms like Coursera and LinkedIn Learning. These allow them to select courses that match their personal needs and career goals.

- Commuter credits: Your employees who commute on public transit can use credits for public transit to make their daily travel easier and more convenient. This includes ride-sharing services and even bike rentals.

- Lifestyle stipends: A monthly stipend allows employees to decide what matters most, whether it's meal kits, pet care, or streaming services.

Why Gen Z Will Demand Subscription-style Benefits

Members of Gen Z are the tech-native generation. They are accustomed to "on-demand everything." Likewise, they desire personalization, flexibility, and choice at work.

As such, it's not far-fetched for Gen Z to opt for flexible benefits packages sooner than later. Here are examples of the factors that have led to subscription-style benefits:

As such, it's not far-fetched for Gen Z to opt for flexible benefits packages sooner than later. Here are examples of the factors that have led to subscription-style benefits:

- Exposure to subscription culture: This generation grew up with subscription culture through platforms like Netflix and Spotify. These services allow them to choose what works best for them. So, it's only natural they'd expect the same flexibility and variety from their workplace benefits.

- Premium value placed on personalization: Gen Z puts a premium on customization, expecting rewards that truly fit their lifestyle. Subscription-style benefits give them the freedom to select what feels most value-added, whether that's wellness, learning, or lifestyle perks.

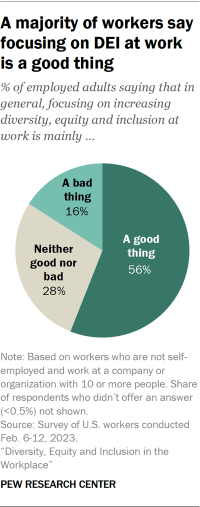

- Call for diversity, equity, and inclusion (DEI): Gen Z is the most diverse generation yet, with a mix of ethnic and racial backgrounds. Since more than 55% of employees believe DEI is good in the workplace, subscription-style benefits help you meet different needs and preferences while showing your DEI commitment.

How To Prepare for Gen Z's Subscription-style Benefits

The message is clear: Gen Z will soon demand flexible and personalized benefits packages.

As an employer, it's right to prepare these packages as early as now. Doing so helps you establish a solid workforce and boost your employee retention.

Here's how to prepare subscription-style benefits for your Gen Z employees:

- Review your current benefits packages

Before diving into flexible offers, assess your existing packages first. What fixed benefits do you currently provide? Do they prove beneficial for most employees? Or is it time to transition from traditional offers to flexible benefits?

Here are common benefits packages being offered by numerous employers worldwide:

- Health insurance: Healthcare benefits are readily offered to employees as mandated by local governments. In the U.S., over 70% of private-sector workers and nearly 90% of state and local government employees have access to medical benefits. Most employers cover basic medical care like doctor visits, hospital stays, and preventive check-ups.

- Ancillary benefits: In the U.S., dental coverage is available to 45% of private workers and 60% of government employees. Many companies offer dental benefits that include cleanings, exams, and common treatments. Meanwhile, vision benefits are offered to 28% of private workers and almost 40% of government employees. Vision coverage helps employees save on eye exams, glasses, and contacts.

- Pharmaceutical plans: This benefit makes prescription medicines more affordable and accessible.

- Voluntary benefits: This is supplemental coverage offered to employees. As it is voluntary workers aren't required to choose them.

- Supplemental health insurance: It adds extra coverage for unexpected costs from accidents, hospital stays, and/or serious illnesses.

- Employee wellness programs: These focus on healthy living through rewards like gym discounts, wellness apps, and stress relief programs.

- Pet insurance: Some employers even cover furry friends, with perks like pet day to support vet visits and pet care.

Tips from the field: Emily Ruby, Owner at Abogada De Lesiones, recommends evaluating company benefits from a legal perspective. She suggests offering benefits, such as insurance, within the bounds of the law to avoid legal and financial consequences.

Ruby says, "When reviewing benefits, employers should always consider the legal side of things. Offering rewards like insurance within the right legal framework helps protect both the company and employees. Ultimately, it prevents costly compliance issues down the line."

Introduce flexible benefit programs

After a thorough review of your current benefits packages, it's time to design flexible programs that meet your employees' needs. The goal here is to plan for what the employees need and want sooner than later.

After a thorough review of your current benefits packages, it's time to design flexible programs that meet your employees' needs. The goal here is to plan for what the employees need and want sooner than later.

It's best to develop a variety of benefit categories and list specific subscription offers for each:

- Health and wellness: Give employees options like gym memberships, meditation apps, or telehealth services. That way, they can take care of their physical and mental well-being on their own terms.

- Fiscal management: Offer rewards like student loan assistance, budgeting tools, and financial coaching. The goal is to help workers feel more secure about their finances.

- Learning and development: Subscriptions to online courses, language apps, and skill-building platforms are beneficial to employees. They let them grow both personally and professionally.

- Family and life support: Provide support for childcare, eldercare, and/or even pet care. That way, employees can better balance work and home life.

- Lifestyle and daily rewards: Think of meal kits, commuter credits, and streaming services. Small everyday rewards that add convenience and improve quality of life.

How do you design flexible benefits programs for Gen Z?

Gen Z expects more from work than past generations. They want to find a job that supports them holistically, beyond just providing a paycheck. A one-size-fits-all benefits package often falls short because it rarely meets everyone's needs.

Subscription-style benefits offer a solution by giving employees a set budget and the freedom to choose rewards that matter to them. The best way to support the whole person is to give them a choice.

As an example, the National Disability Insurance Agency (NDIS) in Sydney allows people with disabilities to locate registered providers and support services, so they can manage their own care within a budget.

Tips from the field: “Personalized support creates real value in people’s lives. With the right tools, individuals can gain more independence and confidence each day. Workplace benefits work best when they follow the same principle. Giving employees options ensures they feel respected and understood,” explains Kellon Ambrose, Managing Director at Electric Wheelchairs USA.

Embrace technology for benefits management

Technology plays a crucial role in business and applies to human resources (HR), specifically for benefits administration and management. Digital tools and technologies help you develop and manage flexible benefit programs throughout the year.

Here are digital tools and advanced technologies to invest in as an employer:

- Benefits admin systems: These simplify the process of handling benefits enrollment, compliance, and reporting. Tools like Workday, ADP Workforce Now, and Gusto make managing benefits more efficient for HR teams.

- Flexible benefit platforms: These platforms give employees credits or stipends to spend on rewards that fit their lifestyle. Options like Benepass, Fringe, and Forma allow workers to choose what matters most to them.

- AI tools and data analytics: AI helps HR predict benefit usage, control costs, and improve personalization. Tools, such as Businessolver's Benefitsolver and Darwin by Mercer, use analytics and chatbots to guide employees.

- Employee self-service portals: Self-service portals put the power in employees' hands, letting them review and manage their benefits anytime. Examples include Rippling, UKG Pro, and Paylocity.

- Mobile applications: Mobile-first tools like Zenefits and BambooHR ensure workers can access and update benefits on the go with just a tap.

For Gen Z, financial wellness isn't complete without addressing student loans. Subscription-style benefits and rewards allow employees to use modern platforms to pick services that help them manage their debt. This kind of support builds a stronger financial foundation and provides access to financial help, such as Freedom Debt Relief.

Using technology for benefits packages also shows you care about your team's long-term success. By easing one of their biggest financial pressures, you're boosting their well-being. And that pays off in better focus, higher productivity, and stronger retention.

Strike a balance between personalization and cost control

Offering flexible benefits programs can be complex. The total cost involved in designing and administering the benefits. So, it's crucial to balance package personalization and cost control:

- Benefits customization: Personalizing benefits allows employees to choose what works best for their lifestyle, whether that's wellness rewards, financial tools, or additional time off. The goal is to give them flexibility without overwhelming their budget.

- Expense regulation: Keeping an eye on costs is just as vital as customization. As an employer, you need to regularly review expenses to ensure benefits stay sustainable while still delivering real value to employees.

Tips from the field: Jeffrey Zhou, CEO and Founder of Fig Loans, emphasizes the need to assess customized benefits packages and the expenditures involved.

Zhou explains, "The key is to provide employees with meaningful choices while keeping an eye on cost efficiency. Striking this balance ensures that benefits remain both valuable to your team and sustainable for your business."

Communicate and update the benefits packages regularly

Whether you’re preparing or have already developed flexible benefits programs for your employees it's vital to communicate these programs through proper orientation and training. Here are the key steps to follow:

- Educate. Make sure employees know what benefits are available and how to use them. Clear communication during benefits orientation and training helps everyone get the most out of the programs.

- Audit. Check in regularly to see which benefits employees are actually using. This gives insight into what's working and what might need adjusting.

- Update. Refresh your benefits package based on feedback and usage trends. Keeping programs up to date shows employees that you're committed to meeting their evolving needs and wants.

Gen Z is reshaping the workplace—and forward-thinking employers are already adapting. By embracing subscription-style benefits that prioritize personalization, flexibility, and inclusivity, you're not just meeting expectations—you're exceeding them. This is your chance to stay ahead of the curve, retain top talent, and drive long-term success.

Solstice is here to help you make it happen. Let’s partner to build a benefits strategy your Gen Z employees will stick around for. Contact us today to schedule a benefits consultation!

comments